How to Save Money on Your Home Loan with a Mortgage Broker San Francisco

How to Save Money on Your Home Loan with a Mortgage Broker San Francisco

Blog Article

Discover the Significance of Employing a Specialist Home Mortgage Broker for Your Home Acquisition

Expertise in Home Mortgage Choices

Navigating the facility landscape of home loan options calls for not just knowledge yet likewise a nuanced understanding of the financial market. A specialist home loan broker brings essential expertise that can dramatically improve the home-buying experience. These experts are skilled in the myriad types of home mortgage products offered, including fixed-rate, adjustable-rate, and specialized car loans like FHA or VA mortgages. Their thorough understanding permits them to recognize the most effective options customized to individual monetary scenarios.

Additionally, home mortgage brokers stay updated on prevailing market fads and interest rates, enabling them to supply enlightened referrals. They can evaluate customers' economic accounts and aid in identifying eligibility, determining possible month-to-month settlements, and comparing overall expenses connected with numerous mortgage products. This level of insight can be vital, particularly for novice property buyers that might really feel overloaded by the alternatives readily available.

Furthermore, a mortgage broker can aid clients browse the ins and outs of funding terms, fees, and possible mistakes, ensuring that consumers make knowledgeable choices. By leveraging their know-how, homebuyers boost their possibilities of safeguarding positive home mortgage conditions, inevitably resulting in an extra economically audio and successful home acquisition.

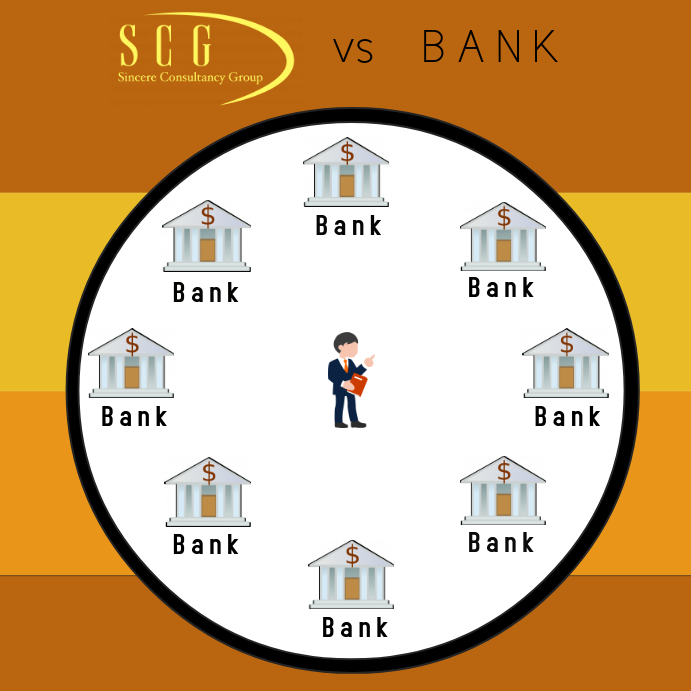

Access to Numerous Lenders

Access to several lending institutions is among the vital advantages of functioning with a professional home loan broker. Unlike specific customers who may only take into consideration a limited number of loaning alternatives, mortgage brokers have developed partnerships with a large range of loan providers, consisting of banks, cooperative credit union, and alternative financing sources. This comprehensive network enables brokers to access a diverse variety of financing items and rate of interest customized to the specific needs of their clients.

By presenting multiple funding alternatives, home mortgage brokers encourage consumers to make enlightened decisions. They can compare various terms, rates of interest, and settlement strategies, making certain that customers discover the most effective fit for their financial situation. This is particularly beneficial in a fluctuating market where problems can differ significantly from one loan provider to another.

Moreover, brokers often have understandings into special programs and motivations that might not be widely advertised. This can bring about prospective financial savings and far better car loan conditions for consumers, eventually making the home purchasing procedure much more economical and efficient. In recap, access to numerous loan providers with a specialist home loan broker enhances the loaning experience by supplying a larger selection of funding options and cultivating notified check my reference decision-making.

Personalized Financial Guidance

A specialist home read this post here loan broker provides tailored monetary guidance that is customized to the individual demands and situations of each borrower. By examining a client's financial circumstance, consisting of income, credit report, and long-lasting objectives, a broker can offer understandings and referrals that align with the customer's special profile. This bespoke technique makes sure that clients are not simply provided with common options, but rather with tailored home loan remedies that fit their specific requirements.

Furthermore, brokers have comprehensive expertise of various funding items and existing market fads, allowing them to enlighten customers concerning the benefits and negative aspects of various funding alternatives. This advice is crucial for borrowers who might really feel overloaded by the intricacy of home mortgage options.

Along with navigating through various lending criteria, a mortgage broker can help customers recognize the effects of various finance terms, prices, and linked expenses - mortgage broker san Francisco. This clearness is important in equipping customers to make informed decisions that can significantly influence their economic future. Eventually, tailored economic support from a home loan broker fosters self-confidence and satisfaction, ensuring that customers feel sustained throughout the home-buying procedure

Time and Cost Financial Savings

Along with offering personalized economic assistance, a professional home mortgage broker can considerably conserve clients both time and cash throughout the home loan process. Browsing the intricacies of home loan options can be frustrating, particularly for newbie homebuyers. A skilled broker enhances this process by useful site leveraging their market knowledge and links to identify the very best home mortgage products readily available.

Additionally, brokers can assist customers stay clear of costly mistakes, such as selecting the incorrect home mortgage kind or overlooking covert charges. Generally, using a specialist mortgage broker is a prudent investment that translates to significant time and financial benefits for homebuyers.

Anxiety Reduction During Process

Exactly how can property buyers navigate the typically difficult trip of acquiring a home loan with higher simplicity? Engaging a professional mortgage broker can considerably reduce this stress and anxiety. These experts understand the complexities of the home mortgage landscape and can lead customers with each stage of the process, ensuring that they continue to be positive and educated in their decisions.

A home mortgage broker works as an intermediary, streamlining communication between customers and lending institutions. They manage the documentation and due dates, which can commonly feel overwhelming. By tackling these obligations, brokers allow homebuyers to concentrate on other essential facets of their home purchase, reducing total anxiety.

Furthermore, home mortgage brokers possess extensive expertise of various loan products and market problems. This insight allows them to match buyers with one of the most suitable alternatives, reducing the moment spent filtering through improper offers. They likewise provide tailored guidance, aiding clients set practical expectations and stay clear of common mistakes.

Ultimately, employing a specialist mortgage broker not only simplifies the mortgage process however likewise boosts the homebuying experience. With specialist support, homebuyers can approach this vital financial decision with higher assurance, making certain a smoother transition into homeownership.

Final Thought

Finally, the benefits of working with a specialist mortgage broker considerably improve the homebuying experience. Their proficiency in mortgage options, access to several loan providers, and capability to supply individualized economic advice are invaluable. Furthermore, the potential for time and cost financial savings, along with stress decrease throughout the procedure, emphasizes the essential duty brokers play in assisting in notified decisions and avoiding costly pitfalls. Involving a home loan broker ultimately leads to a much more effective and effective home purchase trip.

These specialists are skilled in the myriad kinds of home loan items offered, consisting of fixed-rate, adjustable-rate, and specialty loans like FHA or VA home loans.A professional home loan broker provides individualized economic assistance that is customized to the individual requirements and circumstances of each customer. Inevitably, personalized monetary advice from a mortgage broker promotes self-confidence and peace of mind, making sure that customers feel supported throughout the home-buying process.

In enhancement to giving customized monetary advice, a professional home loan broker can substantially conserve customers both time and money throughout the mortgage process. Generally, using a professional mortgage broker is a sensible investment that equates to substantial time and economic advantages for buyers.

Report this page